IUCr activities

The IUCr’s Finance Committee

![FC [FC]](https://www.iucr.org/__data/assets/image/0009/148482/FC.gif)

Background

What is the background against which the IUCr’s Finance Committee (FC) operates? Well, the IUCr is an international ‘not for profit’ organisation registered in Switzerland but with its offices and all its employed staff, amounting to about 25 people, working in Chester in the UK. It exists to serve crystallographers from around the world by bringing our community closer together, providing a home for its publications, supporting scientists (especially young scientists) and delivering other forms of scientific outreach. The IUCr is not subject to UK tax on any of its trading profits, and Swiss tax is not levied as long as the commercial value of the time freely donated by Union members to IUCr work matches the revenue generated by the sales of the Union’s journals, which, thankfully, the Swiss authorities currently accept that it does. In order to preserve its tax-free status within Great Britain, meetings of the FC and the Executive Committee (EC) have to take place outside the UK, and all investment portfolios have to be ‘offshore’.

Thus the finances of the Union are far from straightforward, and it is no surprise that the IUCr needs an FC with long-term membership and a long-term memory (!) to advise each successive EC, as the EC’s composition changes significantly every three years. One exception to that rule is the EC post of General Secretary and Treasurer (GST), which has a tenure of nine years precisely because the holder definitely has to master the intricacies of the finances. My tenure on the FC as its Convenor is actually much longer than that: I joined the FC over two decades ago and still fulfil that role.

Multicurrency complications

A complication arising from the international nature of the Union is that, inevitably, several currencies are involved. For example, most of the income is in US dollars, and most expenditure is in pounds sterling, and yet, until recently, the accounts were expected to be presented in Swiss francs (CHF). Investments are usually spread across both sterling- and US dollar-denominated funds. Recently it has become possible to present the accounts in US dollars rather than in CHF but, nonetheless, currency fluctuations can still create mayhem and lead to exchange-rate losses and gains on the balance sheet, which are difficult to understand and interpret.

Broadly speaking, the Swiss franc has appreciated steadily over decades against most other major currencies, and the pound sterling has depreciated markedly and fluctuated noticeably. Wherever practicable in this article, I will quote values in US dollars, but the Swiss franc and the US dollar are conveniently currently of very similar value. Counter-intuitively, the fall in the value of sterling that we have seen over the last decade against a broad range of currencies is not bad news for the Union’s finances. This is because most of our expenses are the salaries of the Chester office personnel, and these are in pounds sterling. In contrast, most of the income is made up of journal subscriptions, which are mainly denominated in US dollars.

Actually, the only income we have directly in Swiss francs (CHF) is the annual dues from the 52 adhering bodies who pay in multiples of 1,000 CHF per annum depending on the number of votes they hold in the General Assembly. Historically this round number unit has not been changed with inflation, and the total yearly subscription income now represents just about 5% (say approximately 175,000 US dollars) of the annual turnover of the Union, which is, in round figures, approximately 3,500,000 US dollars. The dues would not be enough by themselves to run a Union Secretariat, let alone a publishing arm, and so it is essential that the IUCr has profitable products such as its portfolio of journals to provide another much larger income stream.

Tasks

In years gone by, one major task of the FC was to fix the annual price rises of the journals in order to maintain a sufficient gap between the income and expenditure to fund all the Union’s activities. This would, of course, include the obvious IUCr ‘good works’ like the support of young scientists – as recommended by the IUCr’s Calendar Sub-committee – at meetings organised by the crystallographic community worldwide, ventures such as ‘Crystallography in Africa’ and other outreach activities, such as ‘OpenLabs’. All these initiatives are reported and commented upon from time to time in the Newsletter and on the IUCr webpages. In addition to funding these activities, it is necessary to amass sufficient resources to invest in updating the journal publication process to keep the IUCr in the frontline of publishing. Looking back, this was especially important when journals transitioned to becoming ‘electronic’, because a large investment in research and development was necessary. It was successfully achieved using our own investment reserves.

The necessary across-the-board excess of income over expenditure on journals historically was referred to as ‘Bob’s gap’ after one of my predecessors as Convenor – Bob Diamond. Then, when Sine Larsen was the GST (1996–2005), we refined the approach. It was decided that the prices of individual journals should be more closely related to their specific costs of production, including all aspects of technical editing etc. Thereby the pricing of each journal represents the work involved in its production. More recently, we have tended to tie our annual price rises to those of our agents, Wiley, who sell subscriptions to our journals and many others to individual organisations and, more and more, to consortia of buyers who expect a significant discount due to ‘bulk buying’.

Increasingly we have had to decide about the open-access charges that should be levied on authors to provide articles freely open to all readers. Open-access income is now a very significant element of the journals’ revenue, and it is rising year on year as more authors and funding agencies opt to have research papers published free for all to view. There is a natural desire to keep these charges as low as possible – to help serve our crystallographic community – but, at the same time, that wish has to be tensioned against the need to optimise income in order to provide a surplus that can be used to fund the IUCr’s work.

Membership

So, who is involved in the FC? Historically the Convenor used to be a member of the EC who happened to be based in the UK and therefore could liaise easily with the Chester office (this was in the days before the universality of email) and who was familiar with UK employment laws and practices, which is still an important consideration. The choice of the term ‘Convenor’ rather than ‘Chair’ implies that the role is to bring together a group of experts to discuss the finances and make their recommendations to the EC. In the run-up to the 1996 IUCr Congress in Seattle, Mike Hart, then at Manchester University, was the Convenor. When he moved from the UK to become the Director of the National Synchrotron Light Source in the USA, I stepped into the role as an independent, UK-based successor.

The composition of the FC, which meets twice a year, is somewhat flexible (the present incumbents’ names are given below in parentheses). Firstly, given the heavy financial reliance on the functioning of the journals, it is no surprise that the journals’ Editor-in-Chief (Andrew Allen) is a key member, as is the Executive Managing Editor (Peter Strickland) on an ex-officio basis. Of course, the Executive Secretary (Alex Ashcroft) must be there to service the meeting and contribute to it from a comprehensive knowledge of the IUCr’s activities and finances. These days we also regularly invite the Executive Outreach Officer (Michele Zema) to be present as it’s his job to spend some of our money! From the EC, the GST (Luc Van Meervelt) is an unquestionably essential member of the committee, as is the current President of the IUCr (Sven Lidin). Hanna Dabkowska, currently EC Vice-President, is another member of the FC with a keen interest in our finances. In addition, we are lucky to have a well-known crystallographer with commercial experience (Mike Glazer) on the committee. Finally, our current investment advisor is Narasinga Rao, who has also been guiding the ACA’s investment portfolio for many years.

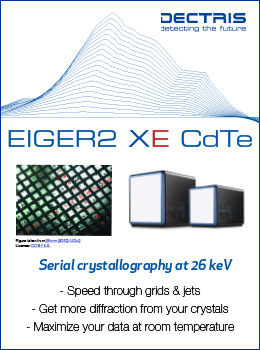

![[FC 2019]](https://www.iucr.org/__data/assets/image/0007/148480/FC2019.png) Attendees at the March 2019 FC meeting (left to right): Andrew Allen, Malcolm Cooper, Luc Van Meervelt, Hanna Dabkowska, Sven Lidin, Peter Strickland, Alex Ashcroft, Mike Glazer and Michele Zema. Not pictured: Narasinga Rao.

Attendees at the March 2019 FC meeting (left to right): Andrew Allen, Malcolm Cooper, Luc Van Meervelt, Hanna Dabkowska, Sven Lidin, Peter Strickland, Alex Ashcroft, Mike Glazer and Michele Zema. Not pictured: Narasinga Rao.

Investments

The IUCr has investment reserves of a similar magnitude to its annual turnover. In fact, if push came to shove and we had to survive on our assets alone and at short notice, our current funds would cover about 10 months of operation. These reserves are certainly needed as a minimum ‘rainy day’ provision. For example, if the COVID-19 pandemic causes a severe lack of submitted papers or a reduction in the number of purchasers of the journals, these funds would hopefully allow us to ride out the ensuing storm. On a more positive note, the investments are there to finance journal developments, such as the ‘electronification’ of all the journals over the last two decades, and the launch of new journals, such as the Journal of Synchrotron Radiation in 1994 and more recently IUCrJ in 2014. New publications swallow money at an alarming rate in their early years: it can cost more than half a million US dollars before a major new journal begins to show an operating profit. That money must come out of our investment reserves, with the hope that one day the cash flow can be reversed, and then the journal’s profits can be channelled back into investments for future needs. In our experience, most of a decade is needed to establish a journal to the stage where it is financially profitable.

Another big-ticket item, which was a landmark in the history of the Union, was the International Year of Crystallography (IYCr2014). This undoubtedly was a big help in raising the profile of crystallography within the wider scientific community. However, the activities before, during and after IYCr2014 did cost the IUCr a lot of money. Between 2012 and 2016, the IUCr's assets decreased by approximately 2 million US dollars, in no small part due to the International Year. In 2017 the FC was faced with some tough choices to safeguard the immediate future of the Union and recommended several cost-cutting measures, which were adopted. Thankfully, consequently, the situation has slowly but surely improved, but the FC is maintaining its vigilance.

All this necessary emphasis on investments means that we are subject to the vagaries of the stock markets and become nervous followers of fluctuations of the FTSE (UK) and the Dow Jones (USA) indices. The role of our financial guru is to get the best advice possible for an organisation that is interested in conservative investments: ones at the low-risk end of the spectrum. We do not seek high-risk investments that could make spectacular gains – or spectacular losses – but ‘safe’ ones that should return some modest capital appreciation and perhaps deliver a dividend. Before COVID-19 reared its ugly head, the IUCr assets stood at some 3.7 million US dollars, of which, in round terms, about 35% was held in sterling, 40% in dollar holdings and almost 25% in a CHF account. The US dollar has held up well as the international currency of last resort, and the Swiss franc continues to appreciate as another safe haven. The UK stock market took a bit of a hit after the arrival of COVID-19 but the Dow Jones has shown more resilience. Overall, at the time of writing, our assets have not been badly affected by the global pandemic.

The future

What does the IUCr’s financial future look like after COVID-19? Well, on the positive side, there are a large number of crystallographers working from home right now, hopefully writing up a backlog of research papers destined for one of our journals! On the negative side, there may be libraries being directed by their administrations to trim their journal subscriptions for 2021, and we might be in the firing line there. After a number of years with worrying negative balances, the 2019 financial out-turn was a modest but very satisfying operating profit of around 10% of turnover, and 2020 might possibly be similar. Clearly, open access will become more and more important financially, but beyond that, it would be unwise to speculate. The future is somewhat uncertain, given the rapidly evolving state of the publishing industry, and we may yet be grateful for our ‘rainy day’ reserves.

Copyright © - All Rights Reserved - International Union of Crystallography